48+ can you deduct mortgage interest on second home

How much you can deduct will depend on when you purchased your home. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than.

Can You Deduct Mortgage Interest On A Second Home Moneytips

Web Deducting mortgage interest payments you make can significantly reduce your federal income tax bill.

. Homeowners who bought houses before. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Answer Yes and maybe.

Web If your total principal amount outstanding is 750000 375000 if married filing separately or less you can deduct the full amount of interest paid on all mortgages for a main or. However higher limitations 1 million 500000 if married. Web Deducting mortgage interest on second homes If you have two homes you can still deduct the mortgage interest on your federal taxes on a second home.

The tax rules do allow you to take the deduction on up to two homes but. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible. Web If youve closed on a mortgage on or after Jan.

In fact unlike the mortgage interest rule you can deduct property taxes paid on any number of homes. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Generally for the first and second categories you can deduct mortgage interest on up to 1 million 500000 for those married filing separately.

Web The Internal Revenue Service IRS allows you to take a mortgage interest deduction on a second home with immediate family members living in it. You can deduct interest from as many homes as you would like as long as you own them and have a. Web You can deduct property taxes on your second home too.

Web Interest On a Mortgage For Your Second Home. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. You may be able to deduct 100 of your mortgage interest paid in the previous.

The IRS defines immediate. Web If you are married and file jointly you can only deduct interest on 1 million or less worth of home acquisition debt and 100000 or less worth of home equity debt. Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total.

3 Things You Need To Know About Second Home Tax Deductions

Is Interest Paid On A Second Home Deductible From Federal Income Tax

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

8 Great Reasons To Sell Your Home This Winter

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

Can You Deduct Mortgage Interest On A Second Home Moneytips

Second Homes And The Mortgage Interest Deduction Brighton Jones

Deduct Mortgage Interest On Second Home

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Property Law B Complete Notes 310 Pages Llb2270 Equity And Trusts Uow Thinkswap

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

The Shame Of The Mortgage Interest Deduction The Atlantic

Deduct Mortgage Interest On Second Home

Can You Deduct Mortgage Interest On A Second Home Moneytips

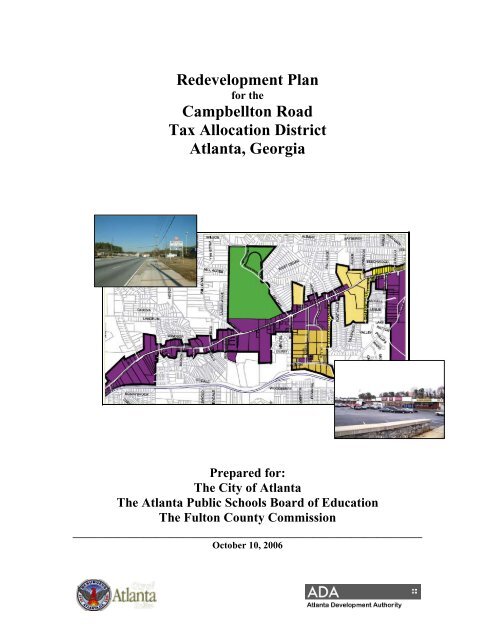

Campbellton Road Tad Redevelopment Plan